Helps make home ownership possible for borrowers who don’t have a large down payment saved up and may not have a strong credit score. You’ll need a minimum FICO score of 580 if you wish to go with the minimum 3.5% down payment.

Loan Products

Conventional Loans

Ideal for borrowers with strong credit, a stable income and employment history, and a down payment of at least 3 percent.

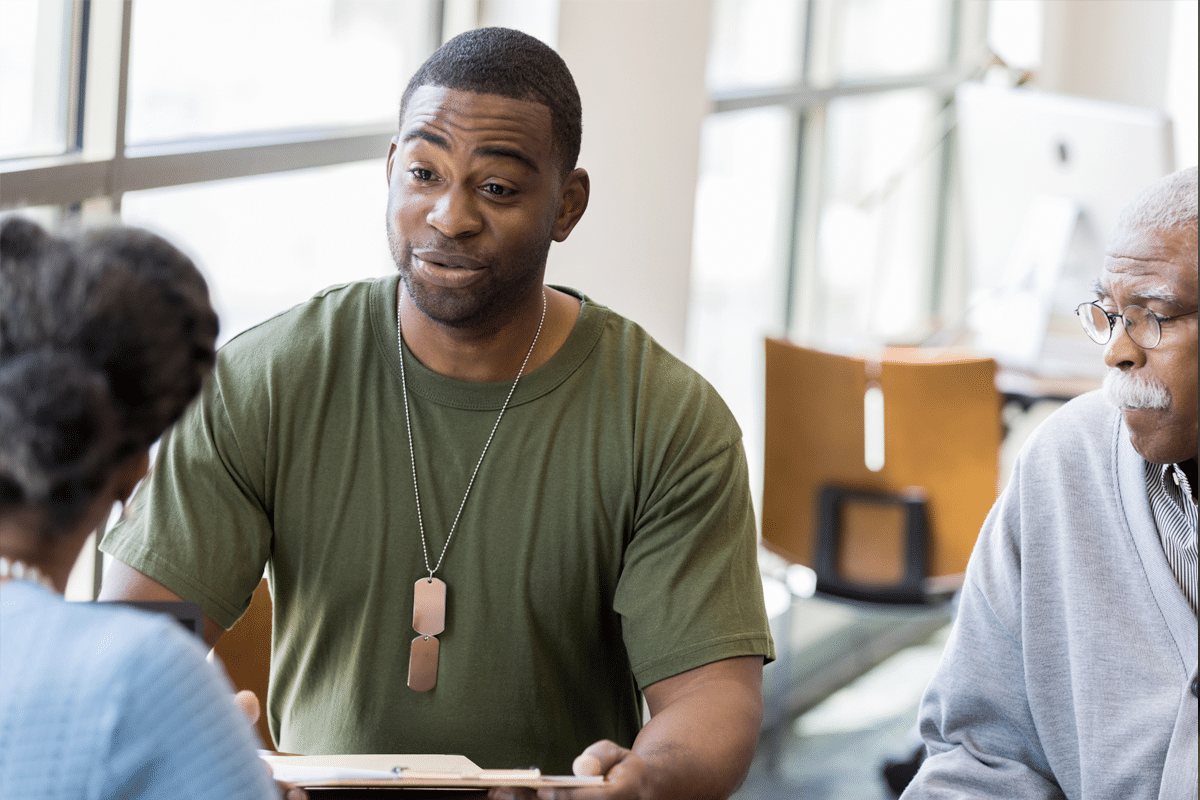

VA Loans

Provides flexible, low-interest mortgages for members of the U.S. military (active duty & veterans). VA loans do not require a down payment or PMI.

Jumbo Loans

Makes sense for more affluent buyers purchasing a home above the conforming loan limit. Borrowers should have good to excellent credit, high incomes and a substantial down payment.

USDA Loans

Helps moderate- to low-income borrowers purchase a home in a USDA-eligible area. You must meet certain income limits to qualify. Some USDA loans do not require a down payment for eligible borrowers with low income.